Home Equity Loan Default Prediction Data

Finance & Banking Analytics

Tags and Keywords

Trusted By

"No reviews yet"

Free

About

Data supporting experiments in credit risk assessment and consumer financial behaviour analysis. It is highly suitable for training supervised machine learning models. The records contain detailed financial characteristics related to applicants for home equity loans, encompassing metrics on debt levels, collateral value, payment history, and delinquency status. The primary purpose of using this data is to develop and test models capable of accurately predicting the likelihood of a loan default (represented by the binary target variable 'y').

Columns

The dataset contains 14 columns detailing various aspects of the loan application and applicant's credit profile:

- index: A simple numerical identifier for the records.

- LOAN: The amount of money requested for the home equity loan.

- MORTDUE: The outstanding balance due on the applicant’s existing mortgage.

- VALUE: The estimated market value of the current property used as collateral.

- REASON: The stated purpose for taking out the loan, categorized primarily as Debt Consolidation (DebtCon) or Home Improvement (HomeImp).

- JOB: The occupational category of the applicant.

- YOJ: The number of years the applicant has held their current job.

- DEROG: The count of major derogatory reports or negative ratings on the credit file.

- DELINQ: The number of times the applicant has been delinquent on credit lines.

- CLAGE: The age of the oldest active trade line (credit account) measured in months.

- NINQ: The number of recent credit inquiries made by the applicant.

- CLNO: The total number of trade lines or active credit accounts.

- DEBTINC: The ratio of total monthly debt payments to total gross monthly income (Debt-to-Income ratio).

- y: The binary target variable (0 or 1), indicating whether the applicant defaulted on the loan.

Distribution

The data is structured as a table, typically provided in CSV format. The sample file,

credit_subset_2.csv, is approximately 249.51 kB in size and contains 14 distinct attributes. The dataset provides 2,920 records for analysis. It should be noted that while the primary columns have a high validation rate, certain fields, such as DEBTINC, MORTDUE, and DEROG, contain missing values, with the DEBTINC attribute missing approximately 21% of records.Usage

This data is perfectly suited for applications in financial risk modelling and machine learning experimentation. Key usage scenarios include:

- Building binary classification algorithms for predicting loan default rates.

- Conducting feature engineering and selection specific to credit scoring models.

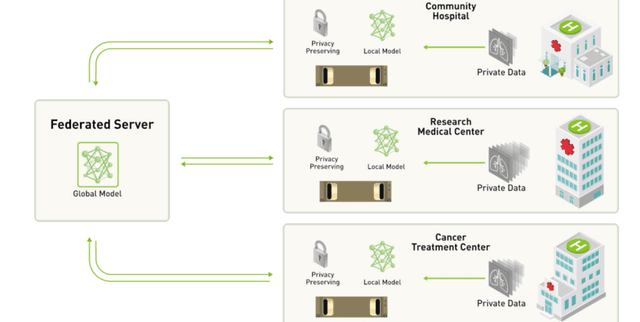

- Training and evaluating decentralised models, such as those used in federated learning environments.

- Performing descriptive analysis to understand the correlation between various financial indicators (e.g., DEBTINC, LOAN amount, MORTDUE) and default outcomes.

Coverage

The data focuses on quantitative and qualitative financial characteristics pertinent to home equity loan applications. It covers essential parameters of consumer debt, employment stability, property valuation, and credit history over time. The scope is restricted to financial behaviour metrics; specific geographic regions or precise time ranges for the original data collection are not detailed within the structure.

License

CC0: Public Domain

Who Can Use It

- Data Scientists and ML Engineers: For developing sophisticated risk prediction models in FinTech.

- Academic Researchers: Studying consumer finance, credit behaviour, and fairness in lending algorithms.

- Banking and Financial Analysts: Seeking to benchmark internal credit models or explore new variable correlations.

- Students: Learning core supervised classification techniques using real-world financial data.

Dataset Name Suggestions

- Home Equity Loan Default Prediction Data

- Credit Risk Assessment Dataset

- HMEQ Financial Attributes

- Consumer Debt and Loan Data

Attributes

Original Data Source:Home Equity Loan Default Prediction Data

Loading...