Historical Chinese Bond Yield Data

Data Science and Analytics

Tags and Keywords

Trusted By

"No reviews yet"

Free

About

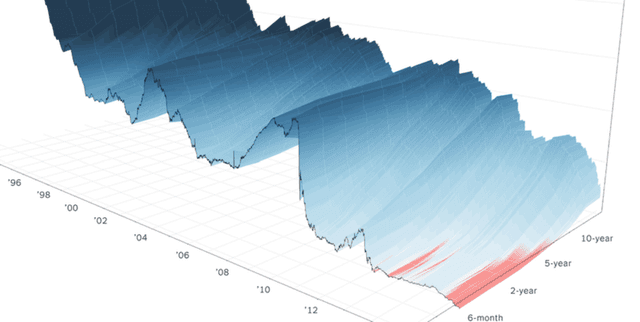

Analyse three major Chinese yield curves with this daily frequency data, crucial for understanding the Chinese economy and market. This collection includes two 'AAA' rated curves and the government bond curve, which is considered almost risk-free. The data is structured in a tabular format, ideal for finance, investing, and data analytics applications.

Columns

- yield curve name: The name of the yield curve or bond. Examples include Government Bond and Medium/Short Term Note (AAA).

- Date: The date of the record.

- 3 month: The 3-month interest rate.

- 6 month: The 6-month interest rate.

- 1 year: The 1-year interest rate.

- 3 year: The 3-year interest rate.

- 5 year: The 5-year interest rate.

- 7 year: The 7-year interest rate.

- 10 year: The 10-year interest rate.

- 30 year: The 30-year interest rate.

Distribution

The data is provided in a single CSV file (

Chinese_Yield_Curve.csv) with a size of 982.43 kB. It contains approximately 11,000 records across 10 columns. The data is expected to be updated on a quarterly basis.Usage

This data is suitable for a variety of financial analyses and visualisations. Ideal applications include:

- Conducting economic research on the Chinese market.

- Developing and backtesting investment strategies.

- Visualising the term structure of interest rates in China.

- Performing data analytics to understand market trends.

Coverage

The dataset covers a time range from 1 March 2006 to 13 May 2022. Geographically, it is focused on China. It is important to note that there is some missing data for longer-term rates: the 30-year rate has 35% of its values missing, and the 10-year rate has 10% missing values.

License

CC BY-SA 4.0

Who Can Use It

- Economists and Financial Analysts: To research and model the Chinese economy and financial markets.

- Investors and Portfolio Managers: To inform investment decisions related to Chinese bonds.

- Data Scientists: For projects involving time-series analysis, financial modelling, and data visualisation.

- Academics and Students: For research and educational purposes in finance and economics.

Dataset Name Suggestions

- Daily Chinese Yield Curve Data (2006-2022)

- China Government and Corporate Bond Yields

- Chinese Financial Market Yield Curves

- Historical Chinese Bond Yield Data

Attributes

Original Data Source: Historical Chinese Bond Yield Data

Loading...

Free

Download Dataset in CSV Format

Recommended Datasets

Loading recommendations...