US Equity Market Volatility Expectations Data

Stock & Market Data

Tags and Keywords

Trusted By

"No reviews yet"

Free

About

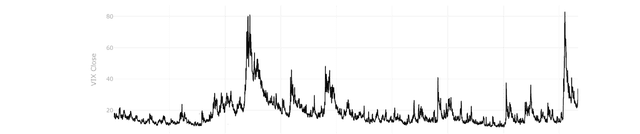

Analysing market sentiment and expectations through the CBOE Volatility Index (VIX) offers a window into near-term equity market stability. Known frequently as the "fear gauge", the VIX captures expectations of volatility derived from S&P 500 index option prices, a standard introduced in 1993. This time-series record provides a historical look at daily market fluctuations, allowing for the study of economic stress periods and investor sentiment shifts since the start of the twenty-first century.

Columns

- Date: The specific trading day for each observation, formatted as a date-time entry.

- VIX Open: The opening value of the index at the start of the trading session.

- VIX High: The peak value recorded for the index during the trading day.

- VIX Low: The lowest value reached by the index within the single trading session.

- VIX Close: The final settlement value of the index at the end of the trading day.

Distribution

The data is provided as a single CSV file named

vix-daily_csv.csv, with a file size of approximately 149.81 kB. It contains 4,199 valid records, ensuring a consistent daily series without missing or mismatched entries. The dataset maintains a high usability rating of 10.00 and is scheduled for annual updates to include the most recent market activity.Usage

This resource is ideal for backtesting trading strategies that rely on volatility triggers or hedges. It is well-suited for economic research regarding the correlation between market fear and actual equity price movements. Additionally, financial analysts can use these historical benchmarks to build risk management models or educational visualisations that illustrate market reactions to global geopolitical events.

Coverage

The temporal scope covers over 16 years of daily trading data, specifically from 2nd January 2004 to 4th September 2020. Geographically, the index represents the expectations of the United States equity market through the S&P 500 options. The records reflect the broad sentiment of institutional and individual investors active in the US derivatives market.

License

Attribution-NonCommercial 4.0 International (CC BY-NC 4.0)

Who Can Use It

Financial analysts can leverage these records to assess historical risk environments and calibrate volatility-based assets. Academic researchers may utilise the daily metrics to study market efficiency and the predictive power of options pricing. Furthermore, data scientists can use the clean time-series format to train machine learning models for forecasting market stress levels.

Dataset Name Suggestions

- CBOE VIX Historical Daily Time-Series (2004–2020)

- S&P 500 Market Volatility Index: Historical Daily Log

- VIX "Fear Gauge" Daily Open-High-Low-Close Archive

- US Equity Market Volatility Expectations Data

- Historical Daily CBOE Volatility Index Metrics

Attributes

Original Data Source: US Equity Market Volatility Expectations Data

Loading...

Free

Download Dataset in CSV Format

Recommended Datasets

Loading recommendations...