Global COVID-19 Financial Stability Measures

Finance & Banking Analytics

Tags and Keywords

Trusted By

"No reviews yet"

Free

About

The data tracks measures taken by governments and central authorities to support their domestic financial sectors in response to the COVID-19 pandemic. Policy responses are detailed and organised into five high-level categories, allowing users to analyse intervention strategies globally. Policies are further segmented into three levels of detail, providing insights into specific actions taken—such as prudential changes, support for borrowers, and various liquidity provisions. The dataset captures essential metadata, including the implementing authority (often the Central Bank or a Supervisory body), the enforcement date, public reference sources, and expected termination dates.

Columns

- ID: A unique identifying number for each recorded policy measure.

- Country Name / Country ISO3: The nation where the policy was implemented, identified by both its full name and three-letter ISO code (covering 157 unique countries).

- Income Level: The economic classification of the country (e.g., High income, Upper middle income).

- Authority: The institution responsible for enacting the policy (e.g., CB for Central Bank, SUP for Supervisory Authority).

- Date: The date the measure was announced or enforced.

- Level 1 policy: The primary classification category for the measure (e.g., Banking sector, Liquidity/funding).

- Level 2 policy: A sub-category detailing the policy focus (e.g., Prudential, Support borrowers, Crisis management).

- Level 3 policy: The most granular classification of the specific measure taken.

- Details of the measure: A written description of the policy action (containing 2828 unique descriptions).

- Reference: A link or citation to the public source of the announcement.

- Termination Date: The date the measure is scheduled to expire (noted for approximately 20% of records).

- Modification of Parent Measure: Indicates whether the measure modifies or extends an existing policy.

- Parent Measure: The ID number of the original policy being modified.

Distribution

The data is provided in a CSV file format, weighing approximately 39.37 MB. It features 14 columns and contains 3723 validated records of policy measures. The collection is regularly updated and remains a work in progress, with an expected annual update frequency.

Usage

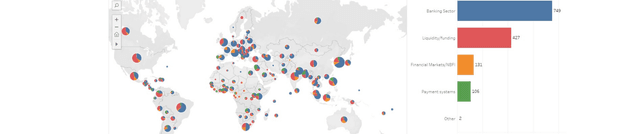

This dataset is an essential resource for analysis related to financial sector resilience and macroeconomic stability during global health crises. Ideal applications include: tracking the prevalence of banking sector interventions (which account for 54% of all measures); studying cross-country differences in regulatory easing; examining the timing of liquidity and funding measures; and evaluating the various tools used to enhance tools for out-of-court debt restructuring.

Coverage

The data spans policies announced or enforced between February 1, 2020, and March 15, 2021. While the policy implementation dates fall within this period, some recorded termination dates extend as far as May 31, 2023. Geographic coverage is worldwide, including measures from 157 unique countries. Categorically, the policy focus is primarily on the Banking sector and Liquidity/funding measures. High income countries constitute the largest share of records (42%).

License

Attribution 4.0 International (CC BY 4.0)

Who Can Use It

- Financial Regulators: To compare prudential responses and crisis management strategies across jurisdictions.

- Academics and Economists: For quantitative analysis of the impact of central bank and supervisory actions on economic outcomes.

- International Development Organisations: To assess financial fragility and support needs in different income level economies.

- Market Risk Analysts: To trace the historical evolution of government support mechanisms during market distress.

Dataset Name Suggestions

- Global COVID-19 Financial Stability Measures

- World Bank Financial Crisis Policy Database

- Government Financial Sector Support Tracker

- Financial Intervention Policy Catalogue

Attributes

Original Data Source: Global COVID-19 Financial Stability Measures

Loading...

Free

Download Dataset in CSV Format

Recommended Datasets

Loading recommendations...